By Eliot Brown and Al Yoon Wall Street Journal

Graphic by Wall Street Journal

Larry Silverstein, the 82-year-old developer who has played a major role in rebuilding the World Trade Center complex, is trying to wrangle better financing from government agencies to restart work on a $2.3 billion office tower on the New York site, according to people familiar with the matter.

Last month, Mr. Silverstein signed his first lease for 3 World Trade Center with a division of advertising giant WWP. He hailed the deal as a big step toward resuscitating the project, which is supposed to rise to almost the height of the Empire State Building but is stalled at eight stories.

Executives at Mr. Silverstein’s Silverstein Properties Inc. have told government officials that they believe they need to restructure a four-year-old municipal-financing package to resume construction upward, the people said.

Four-fifths of the tower’s 2.5 million square feet remain available as vacancy rates rise in Downtown Manhattan, largely because of space in other new World Trade Center developments hitting the market.

Meanwhile, the municipal-bond market last year posted its worst year since 1994, with a loss of 2.55% for the Barclays Municipal Bond Index. While prices have rebounded some this month, it remains challenging for borrowers, especially in a soft leasing environment.

“There’s demand but it’s tempered demand right now for munis,” says Robert DiMella, co-head of MacKay Municipal Managers. “They are not going to be able to come with just any structure and think the market will absorb it,” he says of the possible 3 World Trade financing.

Facing these difficulties, Silverstein executives are in discussions with the state, city and Port Authority of New York and New Jersey to remake a municipal-financing deal that the developer struck with the government agencies in 2010, people familiar with the matter said.

“There are a number of potential modifications to the 2010 agreement that could both enhance the public sector position and benefit the overall project,” said Scott Rechler, the Port Authority’s vice chairman. “It is only prudent for us to consider those alternatives.”

It is unusual for private developers to have access to tax-exempt municipal-bond financing for office-building projects. But little has been typical about the rebuilding of the World Trade Center in the 12 years since the September 11 terrorist attack that destroyed the former complex.

Mr. Silverstein, who signed a 99-year lease for the office space in the complex less than two months before the attack, fought for years with insurance companies, government agencies and others over who would rebuild it and who would pay for it.

Ultimately the Port Authority, which owns the site, and Silverstein agreed the private developer would have the rights to build three towers with more than 7 million square feet. The Port Authority is building the 1,776-foot One World Trade Center tower, set to open next year.

Silverstein’s 4 World Trade Center opened last year, the first new office building on the 16-acre site.

The Port and city and state governments also gave Silverstein access to municipal-bond financing through Liberty Bonds, a program tied to the rebuilding of Lower Manhattan, and federal stimulus dollars.

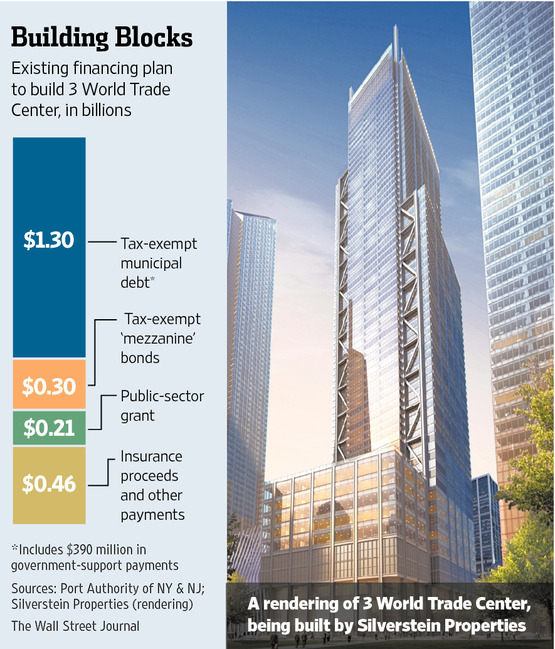

Under a compromise reached in 2010, Silverstein was to finance 3 World Trade Center with $464 million in insurance proceeds and other funds; $210 million in grants from the city and state; $300 million in tax-exempt mezzanine bonds; and $1.3 billion in a mix of Liberty and stimulus bonds. The government agencies agreed to back $390 million of that $1.3 billion in debt.

Silverstein now is discussing raising more private money in exchange for changes to the government debt guarantee, people familiar with the talks said.

Real-estate finance experts consider it highly unlikely Silverstein would be able to move forward today with 3 World Trade Center with conventional construction financing, which is typically more expensive and less available than borrowing by selling municipal bonds.

But the muni market also is no sure thing. It suffered last year due to rising interest rates, Detroit’s bankruptcy and speculation of a Puerto Rico debt restructuring. Investors withdrew $63.5 billion from muni-bond funds during the year, the most since fund tracker Lipper started recording the data in 1992.

Adding to the challenge is the sluggish Manhattan office market. Manhattan rents rose 6.5% last year to $63.40 per square foot, which is still 13.1% below the 2008 peak, according to Cushman & Wakefield Inc.

Lower Manhattan is particularly challenged by high levels of empty space, although it has had success recently luring advertising and media firms from Midtown. Construction of 3 World Trade would add another 2 million square feet of unleased space to a site that already has more than 2 million square feet of vacant space.